The Bitcoin Halving 2024 simply explained.

Every four years, the Bitcoin Halving is in the spotlight of crypto news. Here you can find out what it means and whether it can affect the value of Bitcoin.

Did you know that there will never be more than 21 million Bitcoins? This maximum number is a great advantage compared to conventional money. The limit prevents unwanted inflation. But how is it ensured that there will never be more than 21 million Bitcoins? And how does this maximum quantity relate to halving? To understand this, let's take a closer look at halving.

The cryptocurrency Bitcoin is based on blockchain technology. Basically, you don't need to understand the blockchain in detail for this topic. But if you want to know more about the blockchain, then this article is just right for you. The important thing to know is that the blockchain defines how new bitcoins are created and that there will never be more than 21 million. So-called miners keep the blockchain running by validating transactions. These miners solve complex computing tasks (hashes) with their computers. To do this, they need energy in the form of electricity. They receive bitcoins as a reward for their work. This reward is halved every four years. The day on which this halving takes place is called the halving. In 2009, for example, a miner still received 50 Bitcoins as a reward. After the Bitcoin halving in 2024, this reward will fall again by 50% from 6.25 Bitcoins per block to 3.125 Bitcoins. Incidentally, it is assumed that all 21 million Bitcoins will be generated by the year 2140. This means that there will be no more halvings after that.

To understand this, we need to look at what exactly halving does. If the number of newly created Bitcoins is halved, Bitcoin inflation is also halved. As a result, the market price rises while demand remains the same, as does the Bitcoin price. At the same time, the costs for Bitcoin miners double. This leads to miners selling their freshly mined bitcoins at a higher price.

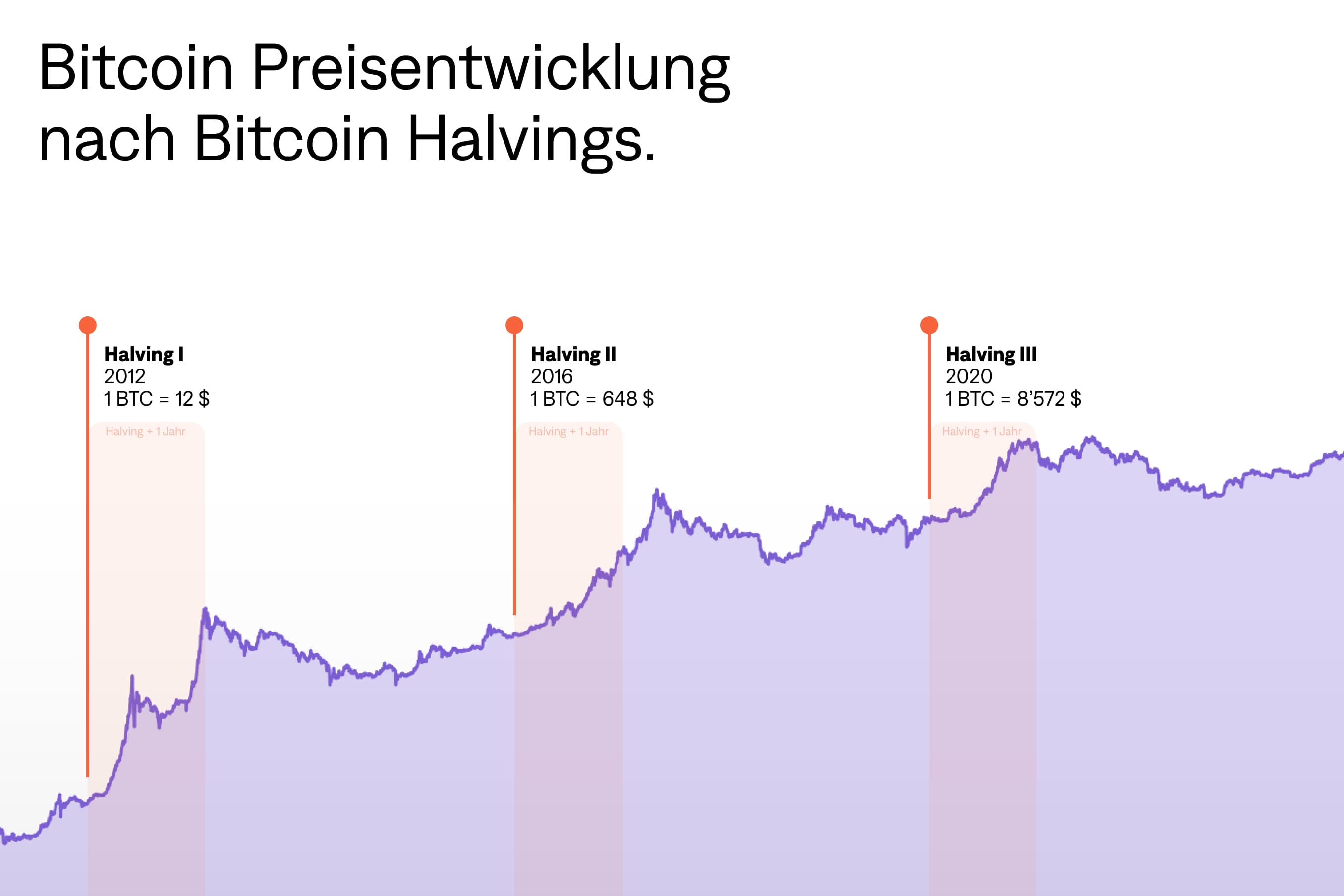

From the Bitcoin Halving 2024, around 164,000 new BTC will be added to the market every year. With around 19 million Bitcoins already mined, this is around 0.86%. This means that the price effect applies to less than 1% of bitcoins. In principle, it can therefore not be assumed that Bitcoin Halving has a major influence on the Bitcoin price. However, if we take a quick look at the Bitcoin price, we can see a price increase after each halving. Let's take a look at why this is the case.

Bitcoin halving can have a major impact on Bitcoin mining. If the reward per block is halved, miners earn less Bitcoin, which can reduce their revenue. But if the Bitcoin price prediction of past halvings comes true, the Bitcoin value could increase, which could offset the decrease in revenue. Nevertheless, miners need to keep an eye on their efficiency to remain competitive and become more profitable over time. Bitcoin Halving forces miners to constantly monitor their energy consumption.

The halving will take place as soon as 210,000 blocks have been mined after the last halving. A specific date has therefore not yet been set. According to current forecasts, the Bitcoin Halving 2024 is expected to take place in April 2024.

In the last Bitcoin Halving, the reward for miners was halved from 12.5 to 6.25 Bitcoin per block. This took place on May 11, 2020 and also resulted in an increase in the price of BTC.

A Bitcoin halving is known to occur every 210,000 blocks and will repeat itself until the year 2140, when the last of the almost 21 million Bitcoin that have ever existed have been mined.

When the last Bitcoin has been mined, the miners will have to draw their income from transaction fees, as there will be no more new Bitcoins to mine. In this phase, the demand for fast and secure transactions will determine the level of transaction fees. Miners can continue to earn money by recording and validating transactions in blocks. Those miners who have the lowest operating costs and use the most efficient hardware may be able to remain profitable during this phase.

Mining becomes more expensive with every halving, which pushes inefficient miners out of competition. This means that it costs more and more money to keep the Bitcoin network running. This in turn drives up the cost of an attack on the blockchain immeasurably. It can therefore be said that Bitcoin Halvings make the blockchain more secure. In addition, the halvings drive up the fixed costs for miners. This means that mining only pays off in the long term if the value of Bitcoin continues to increase. The Bitcoin price is measured in fiat money (e.g. USD or CHF). If these central bank currencies show higher and, above all, constant inflation in the long term, a Bitcoin price increase could be the logical conclusion.

It is debatable whether a halving has a decisive influence on the price of Bitcoin. What is clear, however, is that Bitcoin halving is polarizing and that there has been an increase in the value of Bitcoin after every halving. If you are already counting down the days until the halving, you can find the Bitcoin Halving Countdown here.

This article does not constitute investment advice or a solicitation to buy or sell digital assets or other financial instruments or to enter into any other financial transaction. The main purpose of this article is to provide general information. No representations or warranties, express or implied, are made regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Therefore, it is advisable not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained herein. Some statements in this article may contain forward-looking expectations based on our current views and assumptions. These statements are subject to uncertainties and may lead to actual results, performance, or events differing from the statements made in this article.

The Cryptonow Group and its subsidiaries, as well as any advisory or representative persons, cannot be held liable in any way for this article.

It is important to note that investing in digital assets carries risks as well as potential gains.